The world is a scary place right now. Everyday it feels as if you turn on the news or open up twitter and see countless articles talking about how we’re going into a recession citing that inflation is running rampant or that the Fed has very few options to turn our economy around. Not only that, but tech stocks have dropped 30% and ETH/ Sol are down 69% and 84% respectively, YTD. Much of the wealth that was created in 2020 and 2021 has since evaporated. People are feeling the pain. It’s a tough time to be an investor right now.

However, if you’re like me, you’re tired of being inundated with news articles or twitter posts telling us about how the future looks bleak or that our financial system is going to implode. News flash, it’s not. We’ve let fear, uncertainty and despair dictate our lives for too long. We wrote this article with the purpose of bringing back positivity into our lives and to talk about some of the exciting projects currently being built in web3.

Web3’s future, despite the short term pain, looks brighter than ever.

Innovative Projects in web3

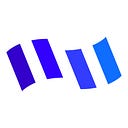

I’d be remiss if we didn’t start this section talking about both Ethereum and Solana, the two most prominent L1 blockchains which serve as the “value layer” of the internet. Both are so much more than a cryptocurrency. They allow for people to build apps and products on top of them with money baked into the code. If you believe in web3, which I’m going to assume you do since you’re reading this, these two L1s are the top contenders to be the settlement layer for the new internet. All sorts of transactions, whether they happen on Ethereum, Solana, or another blockchain, will turn to either of these networks to exchange funds and keep secure, immutable records.

Even through this market sell-off, user adoption metrics keep increasing.

Let’s explore some of the most prominent use cases being currently built on both networks and the industries they are disrupting.

Music

The first company we’ll talk about is disrupting the music industry and seeing major success. That company is Audius. They are a web3 music streaming and sharing platform that puts power back into the hands of content creators. The platform is built on both Ethereum and Solana and they differentiate themselves by removing the middlemen in the traditional music industry and connecting artists directly to their fans. This is vastly different to the status quo. Traditional music labels typically charge 50–90% of artist’s earnings and completely dictate the terms of their agreement. This is due to the power imbalance between an established music label vs. new, up and coming artists.

In Audius’ model, artists have sole ownership of their music and can decide how to monetize themselves on the platform. They can distribute their music free of charge or set custom fees for fans to unlock exclusive content. They’ve seen major success with their model so far and have a user base of 6M users as of August 2021.

I don’t know about you, but I’m excited for a future in which creators have access to un-gated distribution channels that allow them to completely own their work and reap the subsequent rewards.

Wireless Networks

The next company we’ll talk about is Helium. They are a blockchain-powered wireless service that provides long-range connection to nearby Internet of Things (IoT) devices. Their mission is to leverage the power of wireless technology and blockchain to build the “People’s Network” — the world’s first peer-to-peer wireless network that empowers anyone to become a network operator and unleash new classes of devices and applications that are impossible today. In addition to transmitting data, Helium hot spots reward their owners for participating in the network by creating units of a cryptocurrency called $HNT. These tokens can be bought and sold on the open market like any other cryptocurrency, and the more a hot spot is used, the more $HNT tokens it generates. There are over 29 manufacturers on board, over 500,000 Helium hotspots throughout the world, and the Helium Discord community counts over 160,000 members.

Who else is excited for a future where we aren’t reliant on AT&T or Verizon for internet access and where users get rewarded for their value add to the network. 🙋

Emergence of Decentralized Science (DeSci)

The next industry we’ll dive into is science. In true web3 fashion, the movement has branded themselves as decentralized science, or DeSci. DeSci aims to make scientific innovation more open, visible, and frictionless. It broadens the idea of what it might look like to be a stakeholder in new scientific IP. This in turn leads to increased output of new IP to the world by aggregating resources — people and capital — in new ways through DAOs and other web3 structures. Perhaps the most radical vision for DeSci is to empower new and larger groups of stakeholders — patients, researchers, and enthusiasts — with positive market effects that result in cheaper and better products for all.

One company that has stood out in the DeSci space is Molecule. They utilize blockchain tools to help advance and fund early stage drug development. To that end, the company has made several decisions that have advanced the DeSci space, including ideating IP-NFTs, NFTs tied to intellectual property (think, a drug or research-based IP), and launching the VitaDAO community to fund longevity research. They continue to seed new DAOs and help advance the funding of early stage drug development. Their marketplace currently has around 60 research projects available for funding.

Given the healthcare space in the US is very complex and obfuscated, it’s great to see companies and DAOs make strides to make the industry more transparent and push the space forward.

Decentralized Autonomous Organizations (DAOs)

One of the biggest innovations in the web3 space has been the creation of companies run entirely online with strangers across the internet. These companies are called decentralized autonomous organizations, or DAOs. DAOs are web3 native organizations that can be an effective and safe way to work with like-minded folks around the globe. Think of them like an internet-native business that’s collectively owned and managed by its members. They have built-in treasuries that no one has the authority to access without the approval of the group. Decisions are governed by proposals and voting to ensure everyone in the organization has a voice.

Starting an organization with someone that involves money requires a lot of trust in the people you’re working with, which can be hard to do if you’ve only ever interacted with someone on the internet. With DAOs you don’t need to trust anyone else in the group, just the DAO’s code, which is 100% transparent and verifiable by anyone.

This has already opened up so many new opportunities for global collaboration.

Examples of DAO use cases:

- A charity — you can accept membership and donations from anyone in the world and the group decides how to spend donations.

- A freelancer network — you could create a network of contractors who pool their funds for office spaces and software subscriptions.

- Ventures and grants — you could create a venture fund that pools investment capital and votes on ventures to back. Repaid money could later be redistributed amongst DAO-members.

DAOs have showcased what large scale coordination looks like between people who have never interacted in person. While that may seem odd to those not familiar with crypto or web3, it has implications for the future of work and truly globalizes the talent pool available.

Web3 is Impacting Real Estate too

While the impact of web3 in real estate is a nascent innovation, there are a few companies already pushing the space forward with real world applications. Let’s explore three different areas in which NFTs and cryptocurrency are being used to purchase homes and speed up the transaction process.

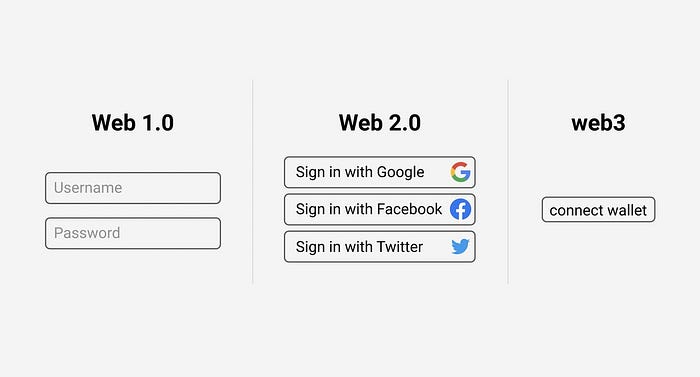

Non-fungible Tokens (NFTs) as Deeds.

Propy is leading the charge around creating the right legal and technical framework to use NFTs to represent property ownership. The record of a purchase is placed on the blockchain and provides access to the legal documents. This minimizes costs for buyers and streamlines the purchasing process down to mere minutes. Propy completed its first sale of a real estate backed NFT in February ’22, for 210ETH (about $653,163 at the time) after receiving 3,000 bids on its online marketplace.

They have the audacious goal of becoming the global network for home titles. No longer do you need to go to your local county clerk in order to get access to home titles, you can go to Propy instead and see the complete history of a homes owners. Eventually, once a home has been on Propy’s network long enough, it would eliminate the need for home title insurance since all previous transactions would be viewable directly on their blockchain network. Read more about their goals in their whitepaper.

Crypto Backed Mortgages

Another company innovating in the space is Milo. They are a fintech startup that is promising to deliver the world’s first “crypto mortgage” by allowing customers to use Bitcoin as collateral to qualify for a 30-year loan. They are differentiating themselves by looking only at your crypto wealth when writing you a loan. No credit history or social security numbers are required when applying for a loan, the application process can be done entirely online with the ability to close on the home in under 30 days.

Crypto price volatility is addressed by changing the interest rate using a ratio of the crypto currency value to loan amount. If it falls below 65%, that triggers a margin call. When the ratio hits 30%, Milo will liquidate the assets and store the value in USD.

Milo is providing the initial stepping stones to allow for real estate transactions to be completely done through cryptocurrency, online, without the requirement to sell and convert to USD to purchase the property. It’s another step forward in widespread web3 adoption.

Fractionalized Investment

At Homebase, we are fractionalizing real estate ownership via NFTs. We envision a future in which you can browse homes on our network as easily as you’d browse homes on Zillow, but have the ability to connect your crypto wallet and buy NFTs of the home representing fractional ownership. This will eliminate much of the traditional friction of buying and selling real estate, and allow users access to markets they may have been priced out of. Real estate is well known to be a a stable appreciating asset that is cash flow positive, everyone should be entitled to the upside of being a property owner.

Why use NFTs you might ask? Three main reasons, the first is that they’re easily traceable, tradable and indivisible. Potential buyers can see the total number of owners who hold an NFT of the property and can see the latest sale price of any of the NFTs resulting in full price transparency on historical sales. Second, as a holder of the NFT you have true ownership of your fractional share of the home. That allows you to collateralize your NFT if you want to take on leverage on your proportional share of the property. Lastly, we want to make fractional ownership feel personal and thus will be making the NFTs feel personal and reflect the home which they represent. People love to show off their possessions to friends and family, we think that by creating 3D models of the home, people will feel the same sense of pride showing off their investments to their friends.

Our ultimate goal is to democratize access to real estate investing and homeownership.

The Promising Future of Web3

This is just the beginning. There are many awesome projects getting built right now in web3; and despite the bear market, they will continue to build and innovate in the space. In fact, many of the biggest companies in web3 were started in previous cycles, and have survived multiple crypto winters. For those who have been in crypto for a long time, this cycle is nothing new. In fact, there have been three previous cycles likes this one. The first cycle peaked in 2011, the second in 2013, and the third in 2017.

These cycles appear chaotic but tend to follow similar orders:

- The price of Bitcoin and other crypto assets goes up,

- which leads to increased interest and social media activity,

- this in turn cultivates net new crypto users who contribute new ideas,

- which leads to new projects and startups,

- resulting in new product launches that inspire even more people, before it all crashes, the hype dies down, and the cycle repeats

Crypto winter isn’t new, in fact each cycle has had significant drawdowns like this one.

Take a deep breathe. Go outside. There’s lots of reasons to be optimistic for the future. I hope this article was helpful in providing context on many different web3 companies innovating across different industries. These are still the early days, many more companies will continue to spring up as web3 technology advances and adoption increases further. I recommend reading Packy McCormick’s latest article Optimism if you’re still feeling stressed.

Web3 is here to stay. Long live crypto.

Domingo, Homebase Co-founder